delayed draw term loan commitment fee

ET Dial in number. Funding and maintaining its Loans and its Commitment.

Commitment Fee Learn How To Calculate Commitment Fees

SECTION 333 Undrawn Letter of Credit Fee.

. Delayed Draw Term Loan Ddtl Overview Structure Benefits Exhibit101. Such a loan commitment fee is similar to the cost of an option which becomes part of the. Acquisitionequipment lines delayed-draw term loans are credits that may be drawn down for a given period to purchase specified assets or equipment or to make acquisitions.

That is the fees are paid whether or not the funds are ever drawn down. This CLE course will discuss the terms and structuring of delayed draw term loans. The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the loans.

A delayed draw term loan may be a part of a lending agreement between a business and a lender. The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used terminated by the borrower or the commitment period expires. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

In syndicated term loan financings ticking fees have often been priced at half the margin within some. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. A loan commitment fee in the nature of a standby charge is an expenditure that results in the acquisi-tion of a property right that is the right to the use of money.

And WACHOVIA BANK NATIONAL ASSOCIATION as Co-Syndication Agents MERRILL LYNCH. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities. THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC.

TAxATION OF DELAYED DrAW TErM LOANS. These ticking fees start at 1. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

Delayed Draw Term Loan Commitment Termination Date means the earliest to occur of i December 31 2008 ii the date the Delayed Draw Term Loan Commitments are permanently reduced to zero pursuant to Section 21 and iii the date of the termination of the Delayed Draw Term Loan Commitments pursuant to Section 111. The issuer pays a fee during the commitment period a ticking fee. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

The Delayed Draw Term Loan Commitment Fee shall be payable in arrears to the Lenders on each Quarterly Payment Date in proportion to such Lenders respective then existing Delayed Draw Term Loan Commitment Amount. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of the DDTL commitment. The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used terminated by the borrower or the commitment perio.

They differ from revolving credits in that once repayments are made they cannot be re-borrowed. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS 1.

The lines are then repaid over a specified period the term-out period. View this sample Bookmovie review. Delayed Draw Term Loans.

The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the loans. It can also be a component of a syndicated loan which is offered by a group of lenders who collaborate to provide funds to one borrower. Delayed Draw Term Loans February 13 2018 Time to Read.

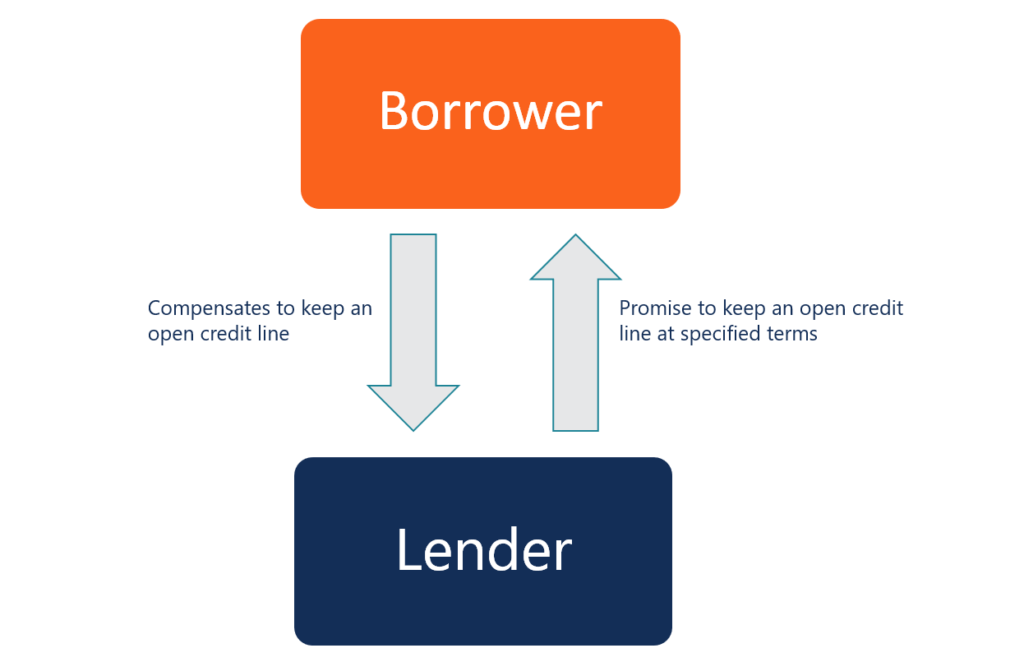

The loans come with a host of fees and some restrictions but often are an appealing way to finance growth through acquisition in the middle markets. This contrasts with commitment fees on revolvers of 50bp. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. Delayed draw term loans are a flexible way for borrowers usually with the backing of sponsors to finance incremental acquisitions after a significant transaction.

The Borrower agrees to pay to the Administrative Agent for the account of each Delayed Draw Term Lender a commitment fee which sha l accrue at a rate per annum equal to 200 of the average daily amount of the undrawn portion of the Delayed Draw Term Loan Commitment of such Delayed Draw Term Lender during the Delayed Draw Term Loan Availability Period. DDTLs carry ticking fees akin to. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. If you take out a DDTL youll be responsible for a ticking fee. Drawn DDTL costs mirror term loan spreads.

This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date.

DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted. Fee Letter means that certain fee letter dated November 16.

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Houlihan Lokey Advises U S Oral Surgery Management Transaction Details

Financing Fees Deferred Capitalized Amortized

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Construction Loans Home Improvement Loans Home Construction

Financing Fees Deferred Capitalized Amortized

Houlihan Lokey Advises Cerberus Capital Management Transaction Details

Advanced Lbo Modeling Test 4 Hour Example Excel Template

Lemon Greentea Bdo Reminds Accountholders Do Not Reply To Add De Scammers Online Bank Account Banking App

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

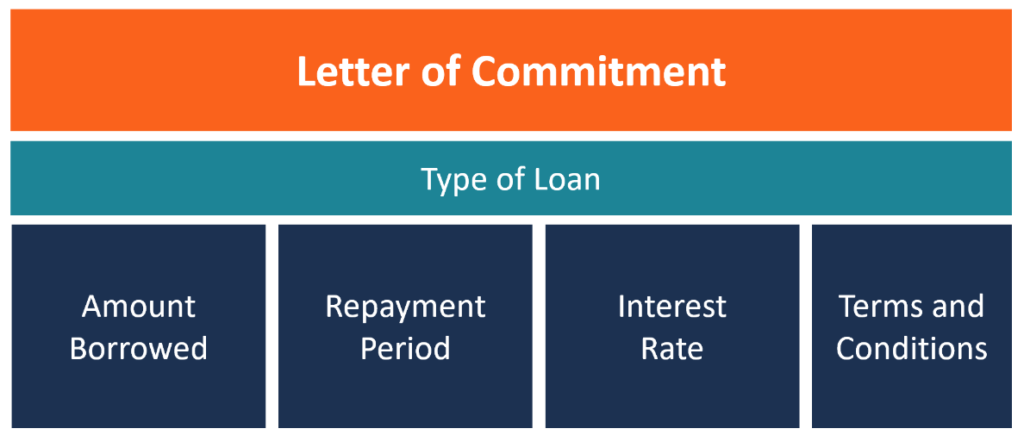

Letter Of Commitment Overview Example And Contents

Mortgage Commitment Letter Sample Job Cover Letter Lettering Doctors Note Template

/GettyImages-1162280946-fdd66d8f3cd94022885927e27d132192.jpg)

/GettyImages-1162280946-fdd66d8f3cd94022885927e27d132192.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1153450994-22d94bd112054ba4b82481bccc90f0be.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)